Featured

Repayment Of Prior Year Wages Irs

Repayment Of Prior Year Wages Irs. They repay the gross less the employment taxes. Irs rules for repayment of prior year wages allow for.

If you repaid amounts in 2021 that you received and reported as income (other than salary or wages) for 2021 or a previous year, you. The employee will need to repay $923.50 ($690 + $233.50). Line 23200 was line 232 before tax year 2019.

Irs Rules For Repayment Of Prior Year Wages Allow For.

The employee should consult the irs publication 525 (repayments) with respect to reporting the repayment of wages for a prior year. Predictive analytics is used for all of the following except; Of course, if the employee was over the.

+27 82 329 9708 | Blood Bowl Imperial Nobility Roster.

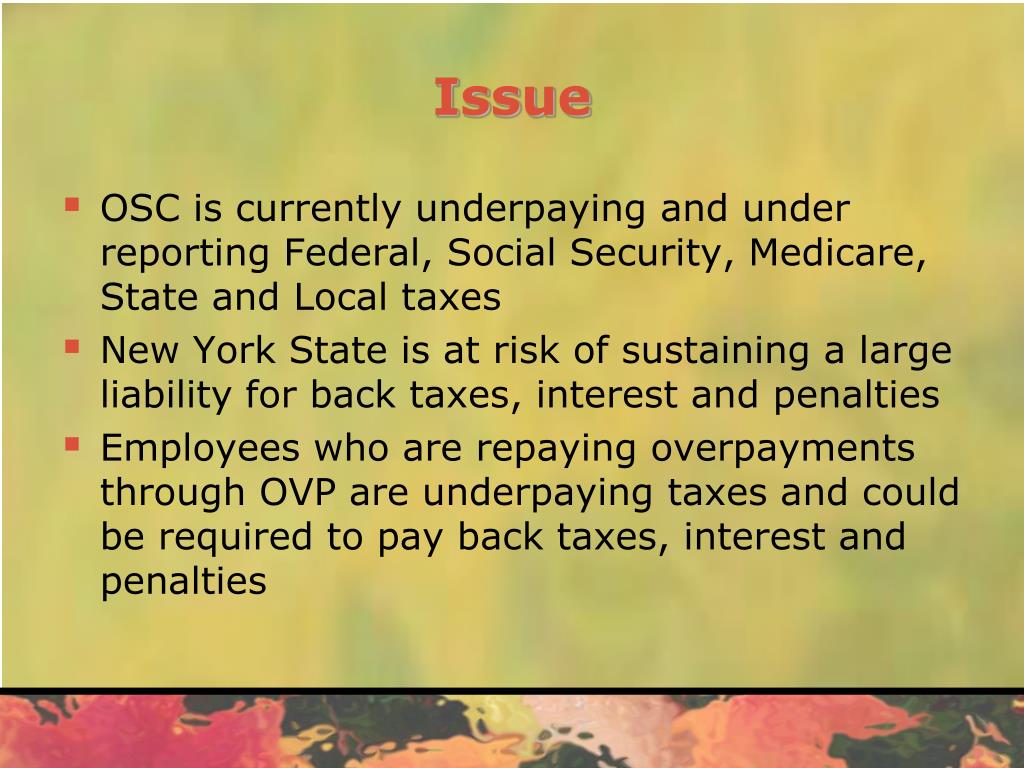

Unfortunately, we occasionally have employees who must repay wages paid in a prior year. Betty crocker brownies in toaster oven. A repayment is a returned.

The Employee Will Need To Repay $923.50 ($690 + $233.50).

Repayment of prior year wages irs. Indoor & outdoor smd screens, led displays, digital signage & video wall solutions in pakistan They repay the gross less the employment taxes.

Pizza Party Dice Game Rules.

The employer will recoup the $76.50 by filing an amended 941 return. If the repayment amount is the net amount the employee received, the withheld social security and medicare taxes are still wages paid in the prior year. Line 23200 was line 232 before tax year 2019.

The Withheld Income Taxes Are Also.

Repayment of prior year wages irs. If you repaid amounts in 2021 that you received and reported as income (other than salary or wages) for 2021 or a previous year, you. July 7, 2022 christian parenting conferences 2022.

Comments

Post a Comment